Despite the sharp daily gains followed by steep losses, we are no worse off in the market than we were back in March, that is until last Friday. So what has happened in the last five weeks that has the markets changing direction once again?

Corporate earnings are not to blame. By Barclays’ estimate, companies are beating earnings forecast at a record pace in both the US and Europe. According to the data from FactSet, of the companies that have reported first quarter results, 79% have delivered an earnings beat and 74% have delivered a revenue beat. The blended growth rate for the first quarter so far is 9.1% vs the 4.7% analysts expected. What’s more, FactSet estimates that if Amazon’s earnings were excluded from the mix, earnings growth would be up more than 10%. That is well off the 21% average growth we saw in 2021.

I cannot say it’s all about inflation. The last core CPI print was soft, rising 0.3% month-over-month, or less than 4% annual. Core PCE inflation – the Fed’s preferred measure – ran below 0.3% month-over-month in February and March.

Average hourly earnings in the US are also leveling off, with the three-month average at 0.3%. Used vehicle prices are dropping for the third month in a row and oil prices have remained range bound trading roughly around $100 a barrel since March.

Perhaps it was the surprise negative growth the US economy saw in the first quarter as real GDP fell by 1.4%. However, we had a surge in imports which counts as a subtraction in the GDP calculation. This was caused by a series of factors, including a backlog of ships at the end of last year that didn’t get delivered until this year and a domestic recovery that could be ahead of the rest of the world (more import demand than export).

If you dig deeper into the numbers, they were impressive. Consumer spending was up 2.7% at an annual rate, business fixed investment was up 9.2% and home building was up 2.1%. Those numbers make up the “core” GDP which rose at a robust 3.7% annual rate. This is not something you’d see during a recession.

So if it’s not corporate earnings, runaway inflation, or the economic data, then why are all the financial markets, including the bond market, doing so miserably?

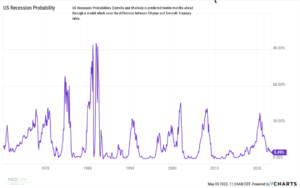

My guess is that if I were to ask 10 people whether they felt the economy will be better-off or worse-off in 6-8 month, all 10 people would tell me worse-off and that a recession is almost certain. The consumer sentiment in March dropped to levels we had not seen since the financial crisis. There has been so much negative news and talk about a global slowdown, that there is very little confidence in the Fed’s ability to navigate a soft landing while also trying to bring inflation down to their 2% annual growth goal.

Our view remains cautiously optimistic. We expect growth to slow from record highs in 2021, to more normalized levels, which we would say is already priced into the market. Though, we are having a hard time seeing data which would suggest corporate earnings growth turning negative and an economic contraction that would call for a recession in the next 12 months.

Is it time to sell, buy or just hang tight?

With the S&P down 15%, the tech heavy Nasdaq down 25% and the aggregate bond market down over 12% so far this year. Much of the damage has already been done with many investors already pricing in a recession for this year or the start of 2023. Valuations on both the S&P as well as the Nasdaq appear fairly-valued at these levels with less downside risk in near term, assuming earnings growth remains positive and we don’t have additional catalysts to drive inflation or long term interest rates higher.

With no foreseeable end to the Ukraine conflict, and the Fed expected to raise the fed funds rate again on the June 15th and possibly July 27th meetings, we expect the uncertainty to remain a focus and therefore volatility will remain in the market through the summer.

Although we believe the equity markets are set up to see a strong rally into year end, we are not looking to make any drastic changes over the next couple months as we try and get a better read on the inflation data and the Fed.

For decades people have obsessed over the self-driving car, which was once reserved as only science fiction on the big screen, has now come to be reality. There are already several autonomous vehicles driving on the roads today by the firms developing the technology. However, it is conceivable that fully autonomous taxi services could be operational in some metropolitan cities as early as 2020. Las Vegas has been one of those cities that has been leading the effort and has digitized its roadway information for autonomous vehicles to navigate the city safely.

This exciting new industry is expected to be generating $10 Trillion in global revenue by 2030(1). But who will benefit and what does it mean for automakers like Ford and GM as well has the ride share companies Lyft and Uber?

It is expected that there will be four main segments of participation within the autonomous market.

- Vehicle & Hardware Manufactures

- Platform Providers

- Ride Hailing Companies

- Owner/Operator of Vehicle

Vehicle & Hardware Manufacture:

The cost per mile to operate a personal vehicle is about $0.70 per mile. It is expected that with autonomous vehicles, that cost will go down to $0.35 per mile (1). This will most definitely have an effect on personal vehicle ownership as people will find it more economical to utilize autonomous taxi services. This could essentially have a major effect on future auto sales and for those automakers that are not leading the way in this technology, they may find themselves struggling. Many of the automakers today, such as Tesla, GM, Ford, Nissan, Jaguar, BMW and Volvo, have initiatives to bring AV’s to market by 2020 or 2021.

Major component manufacturers of the computational hardware and sensors that enable autonomous driving may be well positioned to profit. Companies such as Nvidia, Aptiv, Mobileye, Bosch, Continental, NXP and Cisco are leading the way in this area.

Platform Providers:

Companies such as Google’s Waymo, Baidu, Amazon, Aptiv are considered potential platform providers. Some automakers have also acquired firms or are working on their own platforms such as Volvo, Tesla, GM and Nissan.

These platforms will own the autonomous technology built into vehicles, offering even more value than the Uber and Lyft ridesharing platforms. It will still depend on how much control they retain, not only over both the autonomous driving sensors and software, but also over the data that the sensors gather on road conditions, obstacles, traffic, and near-misses.

Ride Hailing Companies:

These are the platforms such as Lyft and Uber, which will use the technology for attracting customers. About 5% of autonomous taxi revenues most likely will go to companies that originally generate the traffic. However, Uber, Lyft and DiDi will not be the only platforms that will be generating traffic going forward. There may be some tougher competition and companies that have a captive audience using voice recognition AI such as Amazon, Apple or Tencent which could easily enter this segment. Even Tesla has plans on operating its own ride hailing Tesla network.

Owner:

The owner/operators of self-driving taxis are likely to grab the lion’s share of revenues. This group very well could include individual auto owners who want to connect their own Tesla or autonomous car on a ride hailing network , but my guess is, as self-driving taxis become an efficient and economical way to commute, you will see corporate fleets being maintained and managed by larger firms already in automobile business – companies like Avis and Enterprise.

- Ark Investment Management LLC.